Option clearing houses play a crucial role in the settlement of options contracts. An option clearing house, also known as a clearing corporation, is an organization that acts as an intermediary between buyers and sellers of options contracts. It helps to reduce the risk associated with options trading by ensuring that both parties to a trade fulfil their obligations.

What Is The Role Of An Options Clearing House?

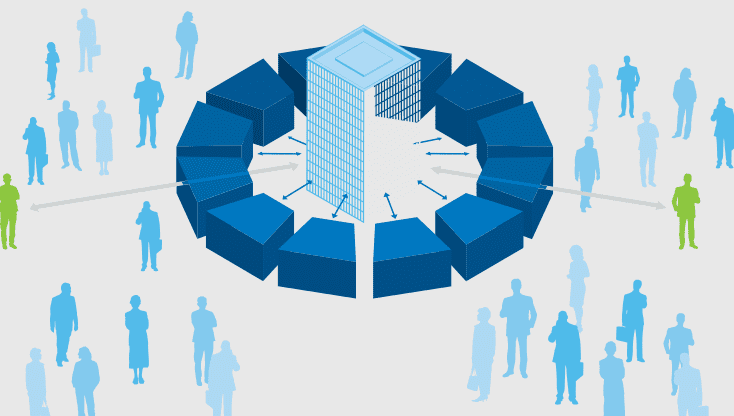

The main role of an options clearing house is to act as a neutral third party that ensures the smooth settlement of options contracts. When a trade is executed, the clearing house steps in to guarantee the performance of both parties to the trade. This means that, if one party fails to fulfil their obligations, the clearing house will step in to ensure that the other party is protected.

The clearinghouse also plays a critical role in the process of margining. Margining is a process by which the clearing house requires traders to provide collateral to cover their potential losses. This helps to reduce the risk of a trader defaulting on their obligations. The clearinghouse calculates the required margin for each trader daily, based on the volatility of the underlying asset and the trader’s overall exposure.

In addition to its role in margining, the clearing house also provides a central repository for options contracts. This helps to ensure that the contracts are standardized and that there is a clear and consistent record of all trades. The clearinghouse also provides trade reporting services, which helps to increase transparency in the options market.

Benefits Of Using An Options Clearing House

The use of an options clearing house provides several benefits to traders, including:

Reduced Risk: By acting as an intermediary between buyers and sellers, the clearing house helps to reduce the risk associated with options trading. This is because the clearing house guarantees the performance of both parties to the trade, which helps to reduce the risk of default.

Increased Transparency: The clearinghouse trade reporting services, helps to increase transparency in the options market. This helps to ensure that all trades are recorded accurately and that there is a clear and consistent record of all trades.

Standardized Contracts: The clearing clearinghouse is a central repository for options contracts, which helps to ensure that the contracts are standardized. This makes it easier for traders to compare and trade options contracts.

Efficient Settlement: The clearing house helps to ensure the efficient settlement of options contracts. This is because the clearing house acts as a neutral third party that ensures that both parties to a trade fulfil.

Reduced Counterparty Risk: The clearing house reduces counterparty risk by acting as a guarantee for both parties to a trade. This means that, if one party fails to fulfil their obligations, the clearing house will step in to ensure that the other party is protected.

Conclusion

Option clearing houses play a crucial role in option settlement contracts. By acting as a neutral third party, the clearing house helps to reduce the risk associated with options trading, increase transparency in the market, standardize contracts, and ensure the efficient settlement of options contracts. The use of an options clearing house provides several benefits to traders, including reduced risk, increased transparency, and reduced counterparty risk. As such, option clearing houses play a critical role in the smooth functioning of the options market.